-

The Call to Serve, in a Life With No One Left to Answer To

On duty, freedom, and the problem of being unneeded As with every year aside from the sole exception of the 2020 covid pandemic, I returned to the UK over Christmas and spent time with my family. Sadly, I messed up my flights and ended up spending a month there, which by my count is about…

-

How I Ditched Banks and Live on Crypto Rails

My bank account has $6 in it. Sometimes less. Once it dipped to $0.47 and I made a meme about it. An AI-generated photo of me wearing a medal with the text: “Me if they gave out awards for having 47c in your bank account.” I posted it to Instagram. I don’t keep money in…

-

What It Feels Like to Be “Retired” When Your Portfolio Is Down 30%

Early retirement is usually presented as a solved state. Reach the number, stop working, let time and markets do the rest.Volatility is acknowledged, but treated as background noise rather than something that materially alters the experience. That assumption holds best in benign conditions.It weakens during a sustained drawdown. A 30% decline is not unusual in…

-

Subsidising Decline

Looking back across the globe to country I was born and raised in, there’s a phrase I keep coming back to: subsidising decline. That’s what staying in Britain under Labour feels like. You earn, you invest, you take risks – and then you watch your rewards siphoned off to fund bureaucracy, inefficiency, and a state…

-

Freedom To vs Freedom From

Last week I very, very, nearly bought a house. It was almost perfect. 4 bedrooms, a pool, and interestingly it was a freehold property, not a leasehold that I’d have to give up after 30 years. It was brand new, direct from the developers. I viewed it three or four times and went through the…

-

An Outsiders Guide to a Crypto Party in Asia

Conference season is once more in full swing in Asia, and as anyone worth their salt in the industry will tell you; the dirty little secret is that the core value of any such event lies not in the conference itself but in the side parties. As with any conference, the real value is to…

-

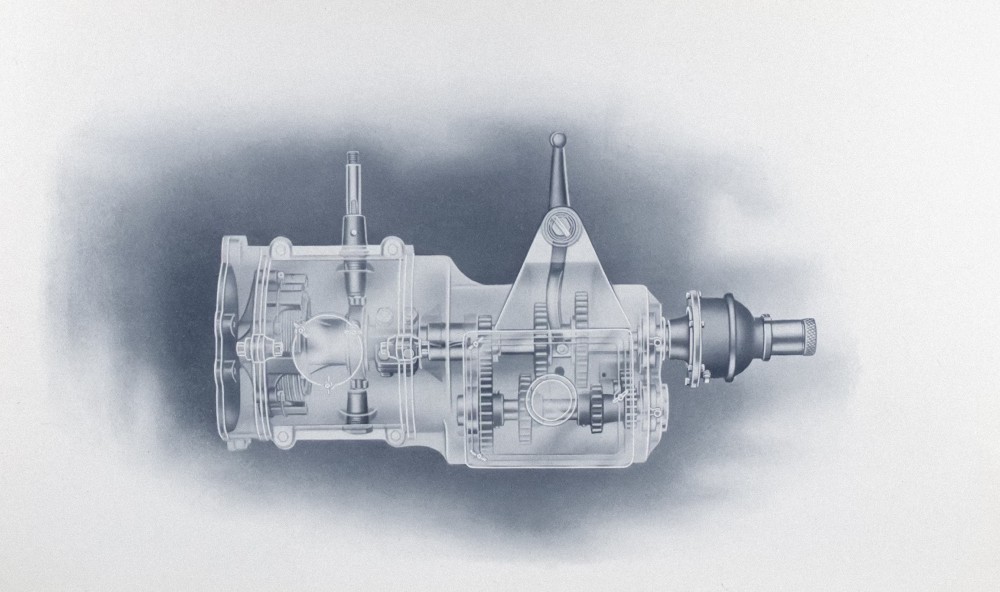

Bitcoin’s Four-Year Cycle Explained: Suck, Squeeze, Bang, Blow

Suck, Squeeze, Bang, Blow. Though those four words may not immediately mean anything to you, those four phases of a cycle have revolutionised your entire life. You may not realise it, but you benefit from them every single day, you most likely used that cycle thousands or millions of times today. First invented almost 150…

-

Any Risk Appetite, One Asset: Building a Portfolio With Only Bitcoin

Bitcoin is risky. It’s a volatile asset. even the most ardent bitcoiner would be at pains to deny that (though some do try). But what occured to me recently is that it would be possible to build a portfolio for any risk appetite, using bitcoin only. This idea is true of almost any publicly traded…

-

The FIRE Portfolio

A famous investing adage goes: “Concentrated bets grow wealth. Diversification preserves wealth” Going all-in on Bitcoin was the concentrated bet that changed my life. It turbo-charged my net worth from a quarter of a million to nearly five million. It was the best-performing asset of the past decade, and I still believe it has plenty…

-

The Number.

The number. It is everything in FIRE circles. Your number. When I worked at the large crypto exchange, one of the Chinese guys walked up to me one day and asked, “What’s your number?” We were already connected, and his body language made it clear he wasn’t asking for my phone number. I knew exactly…